Respond to the following in a minimum of 175 words. Critics claim that the calculation doesnt adequately account for consumers regularly substituting goods and services of lesser or higher quality than those identified in a market basket.

:max_bytes(150000):strip_icc()/consumerpriceindex-FINAL-700b87f61f1441419c9d1562e6537f86.png)

Consumer Price Index Cpi Definition

Of the eight categories used to generate the Consumer Price Index housing is the highest at 41.

/dotdash_Final_Why_Is_the_Consumer_Price_Index_Controversial_Nov_2020-01-253ac0583880472d818421d1b594c704.jpg)

. The most popularly used aggregate price statistic in the US. The Weighting of CPI Components. The rate of inflation is measured as the percentage change between price levels over time.

Achieved as a measure of inflation and as a focal point in the Federal Reserves inflation fight. Inflation refers to the growth rate percentage change of a price index. Give a weighting to the importance of different goods to the typical basket of goods.

Describe the formula s used to determine the unemployment rate. A measure of core inflation is developed and it is empirically estimated for the time period of January 2012December 2019 based on consumer price index data. After accounting for inflation that same item would cost 1050 in 1970 and 2050 in 2021.

Describe the formulas used to determine the unemployment rate. Inflation is the general and ongoing rise in. Most CPI index series use 1982-84 as the basis for comparison.

There are many ways of measuring inflation but one of the most common measures is the Consumer Price Index for Urban Consumers CPI-U which is produced by the Bureau of Labor Statistics. The Chained CPI by 459. Describe how inflation is measured using the Consumer Price Index CPI.

Measure the change in price. Topics include the consumer price index CPI calculating the rate of inflation the distinction between inflation deflation and disinflation and the shortcomings of the CPI as a measure of the cost of living. The most well-known indicator of inflation is the Consumer Price Index CPI which measures the.

Broadly speaking there are two problems as-sociated with using the CPI to measure inflation. Between 2000 and 2020 the CPI went up by 545. In this lesson summary review and remind yourself of the key terms and calculations used in measuring inflation.

There are three main steps to measuring inflation. An index number is a unit-free number derived from the price level over a number of years that makes computing inflation rates easier. Bureau of Labor Statistics BLS set the index level during the 1982-84 period at 100.

The inflation rate can be estimated using a price index which gives a sense of how overall prices in the economy are evolving. No consumer demand at the retail level means no demand for. The Consumer Price Index or CPI is the main inflation report for the futures and financial markets.

It is based on a representative expenditure pattern of urban residents and includes people of all ages. A common calculation is the percentage change from a year ago. The aim is to measure how consumers purchasing power is affected by rising prices.

The Consumer Price Index measures the average change in prices over time that consumers pay for a basket of goods and services. Describe how inflation is measured using the Consumer Price Index CPI. If a price index is 2 percent higher than a year ago for instance that would indicate an inflation rate of 2 percent.

Other goods and services and apparel are the lowest at 34 and 36 respectively. How is inflation measured. This problem has been solved.

A price index is a measure of average prices in one period relative to average prices in a reference period called a base period. See the answer See the answer done loading. It is measured as the rate of change of those prices.

Describe how inflation is measured using the Consumer Price Index CPI. Inflation is an increase in the level of prices of the goods and services that households buy. The Consumer Price Index is frequently criticized for overestimating inflation primarily due to the fixed composition of market baskets.

A price index does not provide a measure of inflationit provides a measure of the general price level compared with a base year. A problem associated with using the CPI a fixed weight index of the cost-of-living is that there are likely to be biases in the index as a measure of inflation. Is the Consumer Price Index CPI a statistic that appears to be a focal point in monetary policy deliberations.

Consumer prices are important because consumer buying drives the US. One of the most commonly used price indices to measure inflation is the consumer price index or CPI. The next highest category transportation at 168 is less than half the size of housing.

Convert into the index multiplying the weight by the price change. Unexpected rises in this indicator usually lead to falling bond prices rising interest rates and increased market volatility. The CPI is a measure of the overall cost of a fixed basket of goods and services bought by a typical household.

Using the Chained CPI to inflation-adjust tax brackets means that tax bracket thresholds increase more slowly and. The CPI is usually computed monthly or quarterly. To calculate the rate of inflation the statistical agencies compare the value of the index over some period in time to the value of the.

Typically prices rise over time but prices can also fall a situation called deflation. As an expenditure-weighted index of cost-of-living changes though the CPI was never intended to be used as an indicator of inflation.

/consumerpriceindex-FINAL-700b87f61f1441419c9d1562e6537f86.png)

Consumer Price Index Cpi Definition

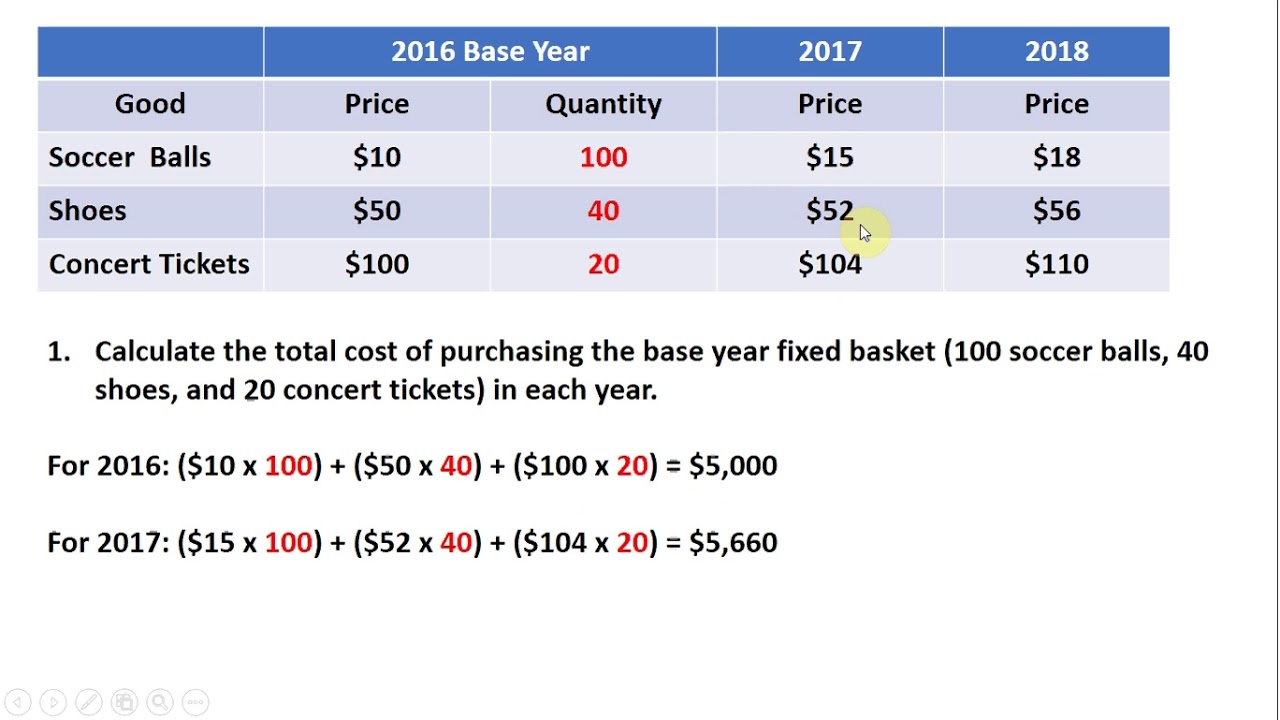

How To Calculate The Consumer Price Index Cpi And Inflation Rate Youtube

/dotdash_Final_Why_Is_the_Consumer_Price_Index_Controversial_Nov_2020-01-253ac0583880472d818421d1b594c704.jpg)

0 Comments